keeping it casual(ish): part 2.

the laws relating to casual employees have changed (again).

tl;dr:

From Monday 26 August 2024, most casual employees have a new ‘employee choice’ pathway to convert to permanent employment.

The waiting period for casual employees to notify you that they wish to convert to permanent employment has reduced to as little as 6 months (for non-small business employers).

You have new obligations for managing and responding to requests for conversion.

Broadly speaking, you can refuse conversion to permanency if the employee still meets the definition of a casual employee, or if there are ‘fair and reasonable operational reasons’.

You have new obligations in relation to issuing the Casual Employment Information Statement in more regular intervals tied to a casual employee’s anniversary.

recap on who is a casual employee.

As of this week (specifically 26 August 2024), there’s a new definition of a ‘casual employee’.

An employee is now a casual employee if:

the employment relationship is characterised by an absence of a firm advance commitment to continuing and indefinite work; and

the employee would be entitled to a casual loading or a specific rate of pay for casual employees.

The relationship will also now be assessed according to the practical reality and true nature of your relationship with a casual employee, despite any contract between you. See Part 1 of our ‘Keeping it Casual’ series, for a comparison of the old definition vs the new one now in effect.

introducing the ‘employee choice’ pathway for casual conversion.

In addition to introducing a new definition of what constitutes a casual employee, the casual conversion laws have also changed (if it feels like they just changed, you’re not wrong, the casual conversion laws last changed in only March 2021).

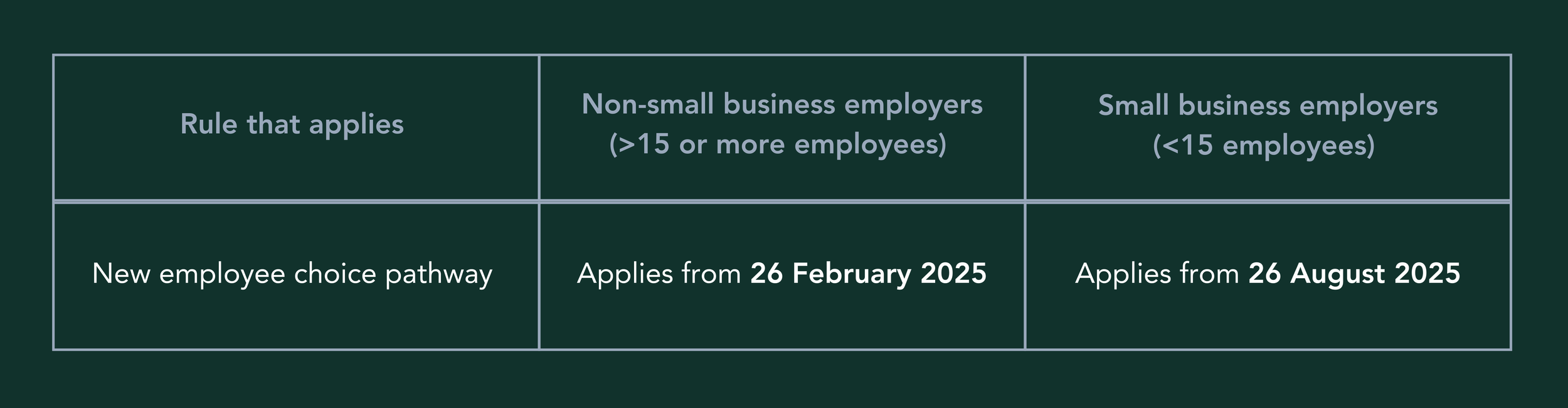

For non-small businesses

As of Monday 26 August 2024, casual employees employed by a business with 15 or more employees can request conversion after a minimum employment period of 6 months of employment.

For small businesses

From 26 August 2025, casual employees employed by a business under 15 employees will have the choice to request conversion after a minimum employment period of 12 months of employment.

Here’s a diagram to break it down

rules for existing casuals engaged before 26 August 2024.

Employees who were employed on a casual basis before 26 August 2024 will stay casual, until they seek to convert to permanency.

As for any prior service before 26 August 2025, this will not count towards the above new minimum employment periods (i.e. 6 and 12 months). In other words, employment before 26 August 2024 isn’t counted when assessing eligibility for the new employee choice pathway.

What does this mean? For existing casual employees, the existing casual conversion rules will continue to operate for a further 6 or 12 months, depending on the size of the employer as follows:

In summary, employees engaged on a casual basis will remain casual until their employment status changes either through:

the casual conversion process (as applicable)

a Modern Award or Enterprise Agreement

a Fair Work Commission order, or

accepting an alternative employment offer (e.g. a separate offer of employment) and starting work on that basis.

the new process under the employee choice pathway.

Here’s a summary of the steps in the process:

new obligations to issue the Casual Employment Information Statement (CEIS).

From 26 August 2024, you must provide the CEIS to any new casual employees before or as soon as possible after they start, and:

to all casual employees employed by a business with more than 15 employees, after:

6 months and 12 months of employment; and

then every 12 month anniversary of their employment thereafter.

for employees employed by a business with under 15 employees, every 12 month anniversary of their employment.

a word to the wise about anti-avoidance tactics.

Under the new laws, you must not:

dismiss or threaten to dismiss an employee with the intention of re-engaging them as a casual to perform the same or substantially similar work;

it is unlawful to make false statements to persuade individuals to enter into casual employment contracts;

you cannot misrepresent employment as casual when it does not meet the new legal definition;

you cannot reduce or vary an employee's hours of work, change their pattern of work, or terminate their employment to avoid obligations related to casual conversion.

While we aren’t into fear mongering, it would be remise of us not to note that significant civil penalties apply for breaches. Individuals can face fines of $93,900, and your business could be on the hook for $469,500.

Head spinning about what you will tell your payroll or tech teams?

We don’t blame you.

Here’s some practical steps you can take to comply with the new legislation:

✅ Diarise (or even better, automate) a notification system tied to the 6 or 12 month anniversary (as above), of each casual employee’s start date, to remind you to issue/re-issue the CEIS.

✅ Review your casual employment contract templates to ensure that the terms better align with the new defintion of a casual employee and that they reference the casual loading paid.

✅ Establish a process for managing casual conversion requests (including creating evidentiary records of written and verbal communications).

✅ Train/up-skill staff who will be on the front end of requests for conversion, about the legal requirements described above (e.g. your HR Partners, Payroll and front-line managers).

If you would like us to review your casual employment contract template or require any other support, reach out.

Not already a subscriber to on the house? Subscribe here. How’d we do with this article? Send us feedback.

This information has not been prepared with your specific circumstances in mind, and may not be suitable for your business. This information is provided for your reference only and does not constitute the provision of legal advice or other professional advice by in house nous. By relying on any information on this website, you assume all risk and liability that may result.